Embark on a journey into the realm of affordable international health insurance for expats, where the need for comprehensive coverage meets the intricacies of living abroad. This narrative unfolds a tapestry of crucial considerations and practical solutions, inviting readers to delve into a world of healthcare tailored for the expat community.

Delve deeper into the nuances of coverage options, factors influencing choices, and the invaluable benefits awaiting expats seeking reliable health insurance solutions overseas.

Overview of Affordable International Health Insurance for Expats

International health insurance for expatriates is a type of insurance coverage designed to provide healthcare services to individuals living outside their home country. This is crucial for expats as it ensures access to quality medical care while abroad, offering peace of mind and financial protection in case of unexpected health issues.

Popular Insurance Providers for Expats

- IMG Global: IMG offers a range of international health insurance plans tailored to the needs of expatriates, providing comprehensive coverage for medical expenses, emergency evacuation, and more.

- Cigna Global: Cigna Global Health Options offers flexible international health insurance plans with customizable options, including access to a global network of healthcare providers and 24/7 customer support.

- Allianz Care: Allianz Care provides international health insurance solutions for expats, offering a variety of plans to suit different budgets and coverage needs, with access to a wide network of hospitals and clinics worldwide.

Factors to Consider When Choosing Affordable International Health Insurance

When choosing affordable international health insurance as an expat, there are several key factors to consider that can greatly impact the coverage and cost of the plan. Factors such as coverage limits, network of providers, premiums, deductibles, and coverage for pre-existing conditions play a crucial role in determining the suitability of an insurance plan for your needs.

Types of Plans Available for Expats

- Comprehensive Coverage: These plans offer a wide range of benefits, including coverage for hospital stays, doctor visits, prescription drugs, and preventive care.

- Emergency-Only Plans: These plans are designed to cover only emergency medical situations, such as accidents or sudden illnesses.

- Regional Coverage: Some plans may focus on providing coverage in specific regions or countries, offering tailored benefits for expats living in those areas.

Factors Influencing Choice of Insurance Plan

- The Expat's Destination Country: Different countries have varying healthcare systems and costs, which can impact the type of insurance plan needed. For example, countries with high medical costs may require more comprehensive coverage.

- Individual Health Needs: Consider your own health needs, including any pre-existing conditions or ongoing medical treatments, to ensure that the insurance plan provides adequate coverage for your specific requirements.

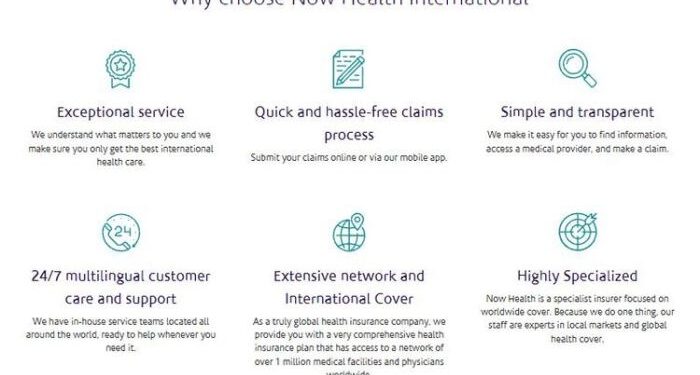

Benefits of Affordable International Health Insurance

International health insurance for expats offers a range of benefits that are essential for maintaining well-being and security while living abroad. From access to quality healthcare to financial protection during emergencies, the advantages of having affordable international health insurance are significant.

Access to Quality Healthcare

One of the primary benefits of affordable international health insurance is the access it provides to quality healthcare services around the world. Expats can receive necessary medical treatment without worrying about the cost or the quality of care they will receive.

Financial Protection in Emergencies

International health insurance offers expats financial protection in case of emergencies, such as accidents or sudden illnesses. With coverage for medical expenses, hospitalization, and treatments, expats can focus on their recovery without the burden of exorbitant costs.

Peace of Mind

Having affordable international health insurance gives expats peace of mind, knowing that they are covered in case of any health-related issues

Additional Benefits

Some international health insurance plans offer additional benefits like coverage for medical evacuation, repatriation, or wellness programs. These added features can be crucial in certain situations, providing expats with comprehensive support beyond basic healthcare coverage.

Real-life Scenarios

There have been numerous real-life scenarios where having international health insurance proved to be crucial for expats. From unexpected medical emergencies to routine healthcare needs, the support and coverage provided by affordable international health insurance have proven to be invaluable for expats living abroad.

Tips for Expats to Lower the Cost of International Health Insurance

When it comes to international health insurance for expats, finding ways to reduce costs can be crucial. Here are some strategies to consider:

Opt for Higher Deductibles

One way to lower your premiums is by choosing a plan with a higher deductible. While this means you'll have to pay more out of pocket in case of medical expenses, it can significantly reduce your monthly insurance costs.

Choose a More Limited Coverage Plan

If you're generally healthy and don't require extensive coverage, opting for a more limited plan can help lower your premiums. Consider your medical needs carefully to determine if a basic coverage plan would suffice.

Explore Group Insurance Options

Joining a group insurance plan, such as through your employer or a professional organization, can often lead to lower premiums compared to individual plans. Explore group options available to you to potentially save on costs.

Compare Quotes and Leverage Discounts

It's essential to shop around and compare quotes from different insurance providers. This allows you to find the best deal that suits your needs and budget. Additionally, don't hesitate to ask about discounts or special promotions that could further reduce your premiums.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle can not only benefit your overall well-being but also potentially lower your insurance premiums. By staying active, eating well, and avoiding risky behaviors, you may be able to qualify for lower rates based on your healthy habits.

Wrap-Up

As we draw the curtain on this discourse, the complexities of international health insurance for expats unravel into a tapestry of security, accessibility, and peace of mind. From navigating coverage options to optimizing cost-saving strategies, the journey to affordable healthcare for expats continues to evolve with each informed decision.

FAQ

Is international health insurance mandatory for expats?

While it may not be mandatory in all countries, having international health insurance is highly recommended for expats to ensure access to quality healthcare and financial protection.

Can expats with pre-existing conditions get affordable coverage?

Some insurance providers offer coverage for pre-existing conditions, but it may come with higher premiums or specific limitations. It's important to explore all options and discuss individual needs with insurance representatives.

Are routine check-ups covered under international health insurance for expats?

Coverage for routine check-ups can vary between insurance plans. Some may include preventive care as part of their benefits, while others may require additional riders or supplementary coverage. It's advisable to review the policy details carefully.