Exploring the landscape of health insurance options for expats in 2025, this introduction sets the stage for an in-depth look at the best plans available. With a focus on key factors and considerations, readers will gain valuable insights into making informed decisions about their healthcare needs.

As we delve deeper into the realm of health insurance plans for expats, we will uncover the various types of coverage, emerging trends, and essential considerations for choosing the most suitable plan.

Overview of Health Insurance Plans for Expats in 2025

Health insurance is of utmost importance for expats living abroad as it provides financial protection and access to quality healthcare services in case of illness or injury. Without adequate health insurance, expats may face high medical costs and limited healthcare options in a foreign country.

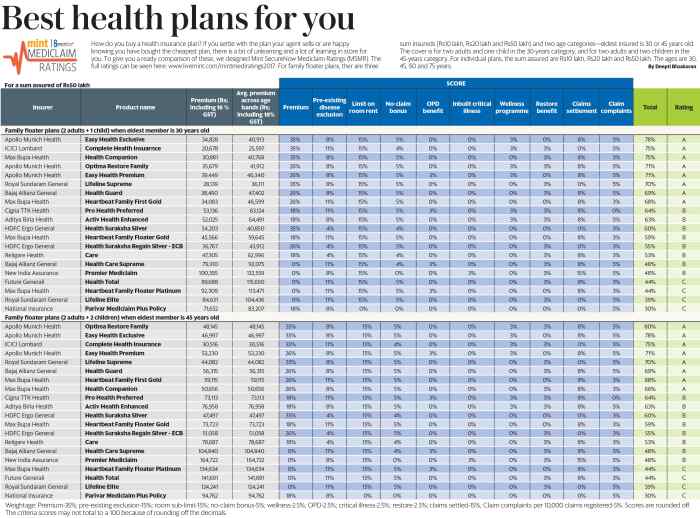

When selecting a health insurance plan, expats should consider key factors such as coverage benefits, cost, network of healthcare providers, coverage for pre-existing conditions, emergency medical evacuation, and customer service. It is essential for expats to choose a plan that meets their specific healthcare needs and budget while providing comprehensive coverage.

Expected Evolution of Health Insurance for Expats by 2025

By 2025, the landscape of health insurance for expats is expected to evolve with advancements in technology, telemedicine services, personalized healthcare solutions, and increased focus on mental health coverage. Insurers may offer more flexible and customizable plans tailored to the unique requirements of expats living in different regions around the world.

Types of Health Insurance Plans

When it comes to health insurance plans for expats, there are different types available to suit their needs and preferences. It is essential to understand the coverage provided by each plan to make an informed decision on what best fits individual circumstances.

International Health Insurance Plans

International health insurance plans are designed to provide coverage for expats living abroad. These plans offer comprehensive medical coverage, including hospitalization, outpatient services, emergency medical evacuation, and repatriation. They typically provide access to a global network of healthcare providers, ensuring expats receive quality medical care wherever they are located.

International health insurance plans often come with additional benefits such as coverage for pre-existing conditions, wellness programs, and 24/7 customer support.

Local Health Insurance Plans

Local health insurance plans are designed for expats residing in a specific country or region. While these plans may offer more affordable premiums compared to international options, they may have limitations in terms of coverage. Local health insurance plans typically provide coverage for basic medical services within the country of residence, but may not include benefits such as medical evacuation or coverage for treatment outside the country.

Expats opting for local health insurance plans should carefully review the coverage offered to ensure it meets their healthcare needs.

Considerations for Expats Choosing Health Insurance

When choosing health insurance as an expat, there are several important considerations to keep in mind to ensure you have the coverage you need. From specific needs to pre-existing conditions, here are some key factors to consider.

Identifying Specific Needs of Expats

- Consider the healthcare system of your host country and whether you need coverage for local healthcare services.

- Look into coverage for emergency medical evacuation or repatriation in case of serious illness or injury.

- Evaluate if you need coverage for routine check-ups, dental care, or maternity services.

Importance of Coverage for Pre-existing Conditions

- Ensure that your health insurance plan covers pre-existing conditions to avoid unexpected medical expenses.

- Check the waiting period for pre-existing conditions to ensure you have timely access to necessary treatments.

- Disclose all pre-existing conditions when applying for health insurance to prevent any coverage issues later on.

Tips for Evaluating and Choosing the Best Health Insurance Plan

- Compare different health insurance plans based on coverage, premiums, deductibles, and network of healthcare providers.

- Consider your budget and choose a plan that offers the best value for your specific healthcare needs.

- Read the fine print of the policy to understand exclusions, limitations, and any additional benefits offered.

- Seek advice from insurance brokers or consult with other expats in your community for recommendations on reliable insurance providers.

Emerging Trends in Health Insurance for Expats

In recent years, the landscape of health insurance for expats has been evolving rapidly, driven by technological advancements and changing consumer preferences. These emerging trends are reshaping the way health insurance plans are designed and delivered to meet the unique needs of expatriates around the world.

Integration of Telemedicine and Digital Health Services

Telemedicine and digital health services have become integral components of health insurance plans for expats in 2025. With the rise of telehealth platforms and mobile health apps, expatriates now have access to virtual consultations, remote monitoring, and online prescription services, regardless of their location.

This integration not only enhances convenience for expats but also ensures continuity of care, especially in remote or underserved areas.

Sustainability and Environmental Considerations

Another key trend in health insurance for expats is the growing emphasis on sustainability and environmental considerations. Insurance providers are increasingly incorporating eco-friendly practices and initiatives into their offerings, such as promoting wellness programs, supporting green healthcare facilities, and incentivizing healthy lifestyle choices.

By prioritizing sustainability, health insurance plans for expats are not only contributing to a healthier planet but also fostering a culture of well-being among expatriate communities.

Concluding Remarks

In conclusion, navigating the world of health insurance as an expat in 2025 presents both challenges and opportunities. By staying informed and proactive, expats can secure the best possible coverage to meet their unique healthcare requirements.

Clarifying Questions

What specific needs should expats consider when choosing a health insurance plan?

Expats should consider factors like coverage for pre-existing conditions, access to quality healthcare providers, emergency medical services, and international coverage.

How are technological advancements shaping health insurance offerings for expats?

Technological advancements are leading to innovations such as telemedicine and digital health services being integrated into health insurance plans, providing expats with convenient and efficient healthcare solutions.

What are the benefits of local health insurance plans compared to international options for expats?

Local health insurance plans may offer more tailored coverage for specific regions and potentially lower costs, while international options provide broader coverage across multiple countries.