Chronic Illness Management Tips for Insurance Holders: A Comprehensive Guide

Delving into the realm of Chronic Illness Management Tips for Insurance Holders, this article aims to shed light on crucial strategies and insights that can make a significant difference in navigating the complexities of managing chronic conditions under insurance coverage.

As we explore the importance of proactive management, effective strategies, and financial planning, readers will uncover valuable information to empower them in their healthcare journey.

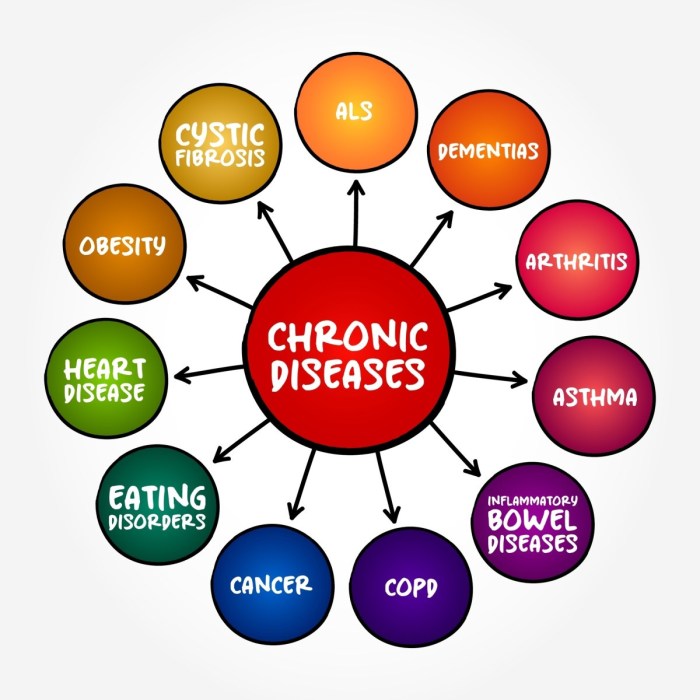

Importance of Chronic Illness Management

Effective management of chronic illnesses is crucial for insurance holders as it can have a significant impact on their coverage and premiums. When chronic conditions are well-managed, insurance companies are more likely to provide comprehensive coverage and lower premiums to policyholders.

This is because proactive management of chronic illnesses can lead to better health outcomes and reduced healthcare costs in the long run.

Impact on Insurance Coverage and Premiums

- Well-managed chronic conditions demonstrate to insurance companies that the policyholder is actively taking steps to maintain their health, reducing the likelihood of expensive medical emergencies.

- Insurance companies may offer better coverage options, such as lower deductibles or co-pays, to individuals who effectively manage their chronic illnesses.

- By managing chronic conditions effectively, policyholders can avoid frequent hospitalizations or costly treatments, which can ultimately lead to lower premiums and overall healthcare expenses.

Strategies for Managing Chronic Illness

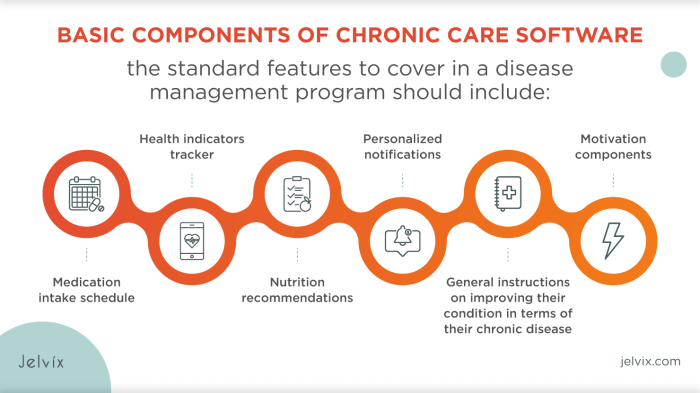

Managing a chronic illness requires a combination of medical treatment, lifestyle changes, and consistent monitoring. Here are some practical tips to help insurance holders effectively manage their condition:

Incorporating Medication Management into Daily Routines

- Create a medication schedule and set reminders to ensure you never miss a dose.

- Organize your medications in a pillbox or use a medication management app to keep track of what you need to take.

- Always have a supply of medications on hand, especially when traveling or in case of emergencies.

- Regularly refill prescriptions ahead of time to avoid running out of important medications.

Importance of Regular Check-ups and Monitoring for Insurance Coverage

- Attend all scheduled doctor's appointments to monitor your condition and make necessary adjustments to your treatment plan.

- Keep track of your symptoms and any changes in your health to discuss with your healthcare provider during check-ups.

- Understand your insurance coverage and the benefits provided for regular check-ups, tests, and monitoring of chronic conditions.

- Submit all necessary documentation and claims to ensure coverage for essential medical services related to your condition.

Lifestyle Changes like Diet and Exercise

- Follow a balanced diet rich in fruits, vegetables, lean protein, and whole grains to support overall health and manage chronic conditions.

- Engage in regular physical activity as recommended by your healthcare provider to improve cardiovascular health and reduce the impact of chronic illnesses.

- Avoid smoking, excessive alcohol consumption, and other harmful habits that can exacerbate symptoms and complications of chronic conditions.

- Seek guidance from a nutritionist or physical therapist to develop a personalized plan that aligns with your specific health needs and goals.

Utilizing Insurance Benefits for Chronic Illness

Managing chronic illness can be a costly endeavor, but navigating your insurance benefits effectively can help alleviate some of the financial burden. Understanding how to utilize your insurance coverage for chronic conditions is crucial in ensuring you receive the care you need without breaking the bank.

Navigating Insurance Policies for Coverage

- Review your insurance policy carefully to understand what is covered for chronic conditions.

- Look for any exclusions or limitations that may affect coverage for treatments or medications.

- Reach out to your insurance provider for clarification on any unclear terms or coverage details.

Pre-Authorization for Treatments and Medications

- Before undergoing any treatment or starting a new medication, check if pre-authorization is required by your insurance.

- Work with your healthcare provider to submit the necessary documentation for pre-authorization in a timely manner.

- Keep track of the approval status and follow up with your insurance company if there are any delays or issues.

Maximizing Insurance Benefits for Specialist Visits and Therapies

- Opt for in-network specialists to maximize your insurance benefits and minimize out-of-pocket costs.

- Explore telemedicine options for virtual specialist visits, which may be covered by your insurance.

- Consider utilizing flexible spending accounts or health savings accounts to cover copayments or deductibles for therapies.

Financial Planning and Support

Financial planning is crucial for individuals with chronic illnesses to effectively manage their out-of-pocket expenses. Whether it's co-pays, medications, or medical supplies, budgeting for these costs is essential to avoid financial strain.

Role of Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

- Health Savings Accounts (HSAs) allow individuals to set aside pre-tax money to cover qualified medical expenses. This can include doctor visits, prescriptions, and other healthcare costs related to chronic illness.

- Flexible Spending Accounts (FSAs) are similar to HSAs but may have different rules regarding rollover funds and eligibility. FSAs also allow pre-tax contributions to be used for medical expenses.

- Both HSAs and FSAs can provide a tax-advantaged way to save for medical expenses, helping individuals with chronic illnesses manage their healthcare costs more effectively.

Financial Assistance Programs and Grants

- There are various financial assistance programs and grants available for individuals with chronic illnesses to help alleviate the burden of medical expenses. These programs may be offered by government agencies, non-profit organizations, or pharmaceutical companies.

- Some examples of financial assistance programs include prescription assistance programs, co-pay assistance programs, and disease-specific foundations that provide grants to help cover medical costs.

- It's important for individuals with chronic illnesses to explore these resources and see if they qualify for any financial assistance programs that can help ease the financial strain of managing their condition.

Last Word

In conclusion, Chronic Illness Management Tips for Insurance Holders offer a roadmap to better health outcomes and financial stability. By implementing these tips, individuals can take charge of their well-being and make informed decisions regarding their insurance coverage.

Key Questions Answered

How does effective chronic illness management impact insurance coverage?

Effective chronic illness management can lead to better health outcomes, which in turn may result in reduced healthcare costs and potentially lower insurance premiums.

What lifestyle changes can positively impact chronic conditions?

Lifestyle changes such as maintaining a healthy diet, regular exercise, and stress management techniques can have a positive impact on chronic conditions.

How can individuals maximize insurance benefits for specialist visits?

Individuals can maximize insurance benefits for specialist visits by ensuring that the visits are medically necessary and pre-authorized by their insurance provider.